Anti Money Laundering Tax Avoidance

Money laundering is the best example of avoiding taxes by hiding the origin and quantity of income. Your organisation has co-written A lawyers guide to detecting and preventing money laundering containing 40 recommendations.

Anti Money Laundering 2021 Romania Iclg

On 8 June 2016 the European Parliament decided to establish a Committee of Inquiry to investigate alleged contraventions and maladministration in the applica.

Anti money laundering tax avoidance. The following paper wants to give an overview over the development and relation between money laundering and tax evasion. In money laundering is prohibited from making a money laundering report where the knowledge or suspicion comes to them in privileged circumstances. While originally Money Laundering was meant for combatting drugs its scope broadened over time from drugs to terrorism financing and lately also to tax.

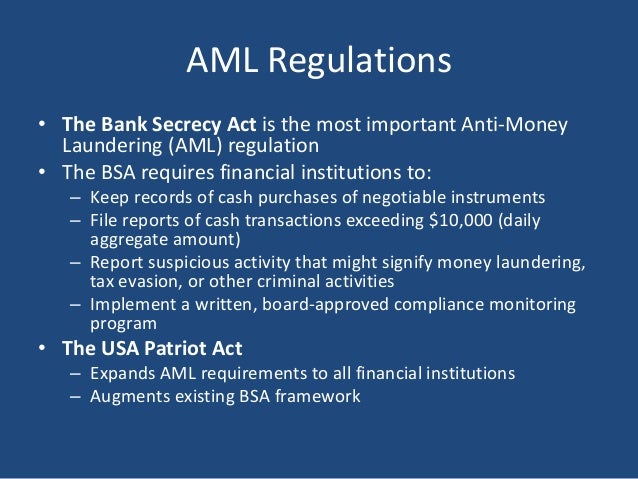

Very clever manilpulation of the law really because a taxpayer convicted of tax evasion could also be pursued for money laundering. Although this paper does not form part of the Guideline on Anti-Money Laundering and. SUPPLEMENTARY ANTI MONEY LAUNDERING GUIDANCE FOR TAX PRACTITIONERS Guidance for those providing tax services in the United Kingdom on the prevention of money laundering and the countering of terrorist financing.

As a reminder on 8 June 2016 Parliament set up a Committee of Inquiry to investigate alleged contraventions and maladministration in the application of Union law in relation to. Tax evasion is a predicate offence for money laundering under these standards. Laundering tax avoidance and tax evasion adopted by Jeppe KOFOD SD DK and Petr JEEK ALDE CZ on the inquiry into money laundering tax avoidance and tax evasion.

This Guidance is issued by Chartered Institute of Taxation. The FATF does not set the global standards for tax crimes or other crimes. This is because the money generated by the manipulation of the tax system has been criminally obtained and hence has to be money laundering.

Counteracting tax evasion tax avoidance and money laundering pdf 95 kB The Swedish Government will give priority to actions for counteracting tax evasion tax avoidance and money laundering and has presented an action plan for this purpose. Anti-money laundering and tax havens As there are substantial similarities between the techniques used to launder the proceeds of crimeand to commit tax crimes inMay 1998 the G7 Finance Ministers encouraged international action to enhance the capacity of anti-money laundering systems to deal effectively with tax-related crimes. Tax avoidance tax evasion and money laundering by multinational companies and wealthy individuals criminal organisations undermine the rule of law and the equality before the law.

The traditional perception was that tax evasion even of a criminal nature was somehow different from money laundering and other financial crimes eg corruption. Fighting tax havens evasion and money laundering. The Anti Tax Avoidance Directive The remain camp just like the Leaver camp in the UK is not adverse to perpetuating lies you will often see post from conspiracies that the only reason we had a referendum was for the rich to avoid the EU Anti-Tax.

Regulatory obligations under the Anti-Money Laundering and Counter-Terrorist Financing Financial Institutions Ordinance AMLO and implement effective measures to mitigate their money laundering ML risks in respect of tax evasion. EU Anti-Tax Avoidance Directive The measure will have effect in the UK from 1 January 2019. Moreover it widens the.

Moreover cooperation between law enforcement and anti-money institutions is not fruitful. This leads to a vulnerability in the system. The Committee calls on the European Commission to promote a political initiative involving national governments and the other European institutions in achieving this goal fostering the consensus needed for this and involving civil society.

On June 262017 the Fourth Anti-Money Laundering Directive enters into force. That means that implementing the FATF standards supports efforts to stop tax evasion. Money Laundering and tax evasion go hand in hand.

The EESC proposes launching a European pact to effectively combat tax fraud evasion and avoidance and money laundering. In a globalized economy financial crimes including tax crimes threaten the strategic political and economic interest of developed and developing countries as well and undermine confidence in the global financial system. Tax evasion tax avoidance or money laundering issues on obliged institutions are not implemented thoughtfully.

Change colors Reset colors Close. Here again there is a complication because HMRC and other countries tax authorities have made any and all unlawful manipulations of the tax system a money laundering offence. It strengthens the existing rules and will make the fight against money.

73 Tax practitioners should be aware that the privilege reporting exemption does not apply to information or other matters which are communicated or given with the intention of furthering a. The FATF is an intergovernmental body that sets the global standards for anti-money laundering counter terrorist and proliferation financing. European Parliament Committee of Inquiry into Money Laundering Tax Avoidance and Tax Evasion PANA 24 January 2017 Committee of inquiry questions to the Council of Bars and Law Societies of Europe CCBE 1.

Aml What Is Anti Money Laundering And Why Does It Matter Mintos Blog

Money Chaussureslouboutin Soldes Fr

Http Www Europarl Europa Eu Regdata Etudes Stud 2017 593803 Eprs Stu 2017 593803 En Pdf

Covid 19 Rethinking Anti Money Laundering Aml And Fraud Risk Management Financier Worldwide

Georgian Lawyers Trained On Compliance With Anti Money Laundering Counter Terrorist Financing Standards Newsroom Pgg Georgia

Money Laundering Tax Avoidance And Tax Evasion Research Papers Youtube

Pdf The Effect Of Tax Amnesty On Anti Money Laundering In Bangladesh

Antimoney Laundering Best Practices Passing An Aml Audit

Money Laundering And Tax Evasion Sanction Scanner

Tax Havens Explained Indiaforensic

Https Www Europarl Europa Eu Cmsdata 112269 Replies Fatf En Pdf

Money Laundering And Terrorist Financing Awareness Handbook For Tax Examiners And Tax Auditors Oecd

Financial System Abuse Financial Crime And Money Laundering Background Paper In Policy Papers Volume 2001 Issue 039 2001

Https Www Europarl Europa Eu Cmsdata 155722 5 20 2002 20eprs Freeports 20in 20the 20eu Exec Sum Pdf

Public Hearing On Combatting Money Laundering In The Eu Banking System Hearings Events Tax3 8th Parliamentary Term 2014 2019 Committees European Parliament

Anti Money Laundering Shulman Rogers Gandal Pordy Ecker Pa

Pdf Money Laundering Tax Havens And Transparency Any Role For The Board Of Directors Of Banks

Emirex On Twitter Know Your Customer Anti Money Laundering Kyc Aml Two Widespread Terms That Appear Ahead Of You When It Comes To Account Creation On A Specific Exchanges Emirexacademy Defines Them

Pdf Establishing The Link Between Money Laundering And Tax Evasion

Post a Comment for "Anti Money Laundering Tax Avoidance"